India’s UPI Expands Globally: Sri Lanka and Mauritius Join the Roster

In a significant stride towards global digital connectivity, India’s Unified Payment Interface (UPI) is set to make its debut in Sri Lanka and Mauritius. The move underscores India’s commitment to bolstering its digital infrastructure and fostering international partnerships.

High-profile Launch: Prime Minister Modi Leads the Way

Prime Minister Narendra Modi, alongside Sri Lankan President Ranil Wickremesinghe and Mauritius Prime Minister Pravind Jugnauth, will witness the historic launch of India’s UPI in Sri Lanka and Mauritius. This momentous occasion, organized by India’s Ministry of External Affairs (MEA), marks a new chapter in digital collaboration between nations.

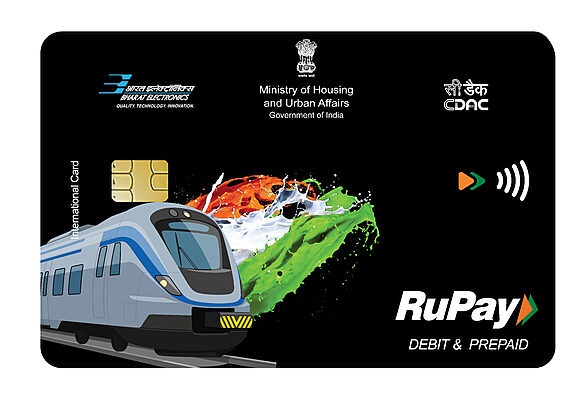

RuPay Card Services Expansion: Empowering Mauritius

Alongside the UPI launch, Mauritius will also witness the introduction of RuPay card services. This expansion aims to facilitate seamless transactions for Indian nationals visiting Mauritius and vice versa. By enabling Mauritian banks to issue RuPay cards, the initiative aims to enhance financial connectivity between India and Mauritius.

Digital Transaction Experience Amplified

The extension of UPI and RuPay card services underscores India’s commitment to fostering digital connectivity with Sri Lanka and Mauritius. With strong cultural and people-to-people ties, this initiative promises to deliver faster and more convenient digital transactions, enriching the experience for individuals across borders.

India’s Fintech Leadership: Sharing Innovation Globally

India has emerged as a frontrunner in Fintech innovation and Digital Public Infrastructure. Prime Minister Modi has championed the sharing of India’s development experiences and technological innovations with partner countries, reinforcing India’s commitment to global digital empowerment.

Expanding Global Footprint: UPI Adoption Worldwide

India’s UPI has been gaining traction globally, with several countries embracing this innovative payment system. From Bhutan to France, and from the UAE to Singapore, the adoption of UPI has been steadily growing, facilitating faster and secure cross-border transactions.

Nepal on the Horizon: UPI’s Next Frontier

Nepal is poised to join the league of countries using India’s UPI, with plans underway for the digital payment gateway to commence operations by February 2024. The agreement between NPCI and Nepal Clearing House Limited signals a new era of digital collaboration between India and Nepal.

Understanding UPI: A Revolutionary Payment System

Unified Payment Interface (UPI) revolutionized the payment landscape since its inception in 2016. This mobile-based, real-time payment system enables seamless fund transfers between bank accounts, offering users unparalleled convenience and accessibility.

Massive Growth Trajectory: UPI’s Remarkable Journey

With over 380 million users, UPI has witnessed exponential growth, particularly during the COVID-19 pandemic. In 2022 alone, UPI recorded a staggering 74 billion transactions, amounting to $1.53 trillion. The system’s user-friendly interface and robust security features have contributed to its widespread adoption.

Conclusion: UPI’s Global Impact

As India’s UPI continues to expand its global footprint, it heralds a new era of digital connectivity and financial inclusion. By forging partnerships with nations worldwide and sharing its technological expertise, India is paving the way for a more interconnected and digitally empowered world.